Consumers have reported feeling ad fatigue from too much advertising on social media and are using untraceable methods, like word of mouth, to recommend products. How can retailers address this issue? Also, as businesses seek to enhance product discoverability, how can they leverage their website’s search and filter functions to achieve this objective?

In this article

- 91% of online consumers in the UK agree they see too many ads on social media

- Consumers often use dark social media to recommend or explore brands

- Filters and search solutions can enhance onsite discoverability

- Next-generation search solutions should focus on discounts and personalisation

- Businesses should leverage technology but focus on what consumers demand

Online shopping has become a habit for many consumers, offering convenience and a way to discover new brands, products, and discounts. In our first article on elusive consumers in e-commerce, we analysed the role of search engines, retailer websites, social media, and customer loyalty programs in improving customer purchase journeys and e-commerce marketing strategies.

However, even though we learned that consumers can benefit from the convenience of browsing, comparing, and purchasing products online, SMB retailers may need to confront a looming challenge to their marketing strategies: ad fatigue and the prevalence of dark social media.

Capterra surveyed 499 regular online shoppers in the UK to understand their preferences and expectations towards advertising and product recommendations on social media, and the factors contributing to ad fatigue. We’ll also discuss actionable strategies and next-generation search solutions that SMB retailers can implement on their websites to overcome ad fatigue and enhance product discovery online. The full methodology can be found at the end of the article.

91% of online consumers in the UK agree they see too many ads on social media

Despite its strong presence on multiple social platforms, an aversion towards social media ads may already be unfolding. Just over nine out of ten surveyed consumers say they see too many ads on social media. Many marketing activities are linked to advertising. As consumers use search engines, social media, or websites to find goods, they are often inundated with advertisements vying for their attention. Social media can seem the ideal place to reach out to consumers, as they are channels where brands can engage with targeted clients, and promote and distribute content.

Still, the growing presence of these marketing messages may be leading many consumers to experience a phenomenon known as ad fatigue. This behaviour refers to the state of exhaustion or disinterest that may arise when a consumer is exposed to too many ads, too frequently, or with little relevance to one’s interests. This situation can lead to consumers becoming desensitised to traditional advertising methods, reducing engagement or even leading to negative brand perception.

Hitting the sweet spot in social media marketing can reap benefits

Whilst the results suggest that consumers are beginning to feel wary of excessive social advertising, businesses should not necessarily cease their activities on social media. Instead, they should exercise caution regarding their behaviour and ensure that their targeting and timing are appropriate and personalised.

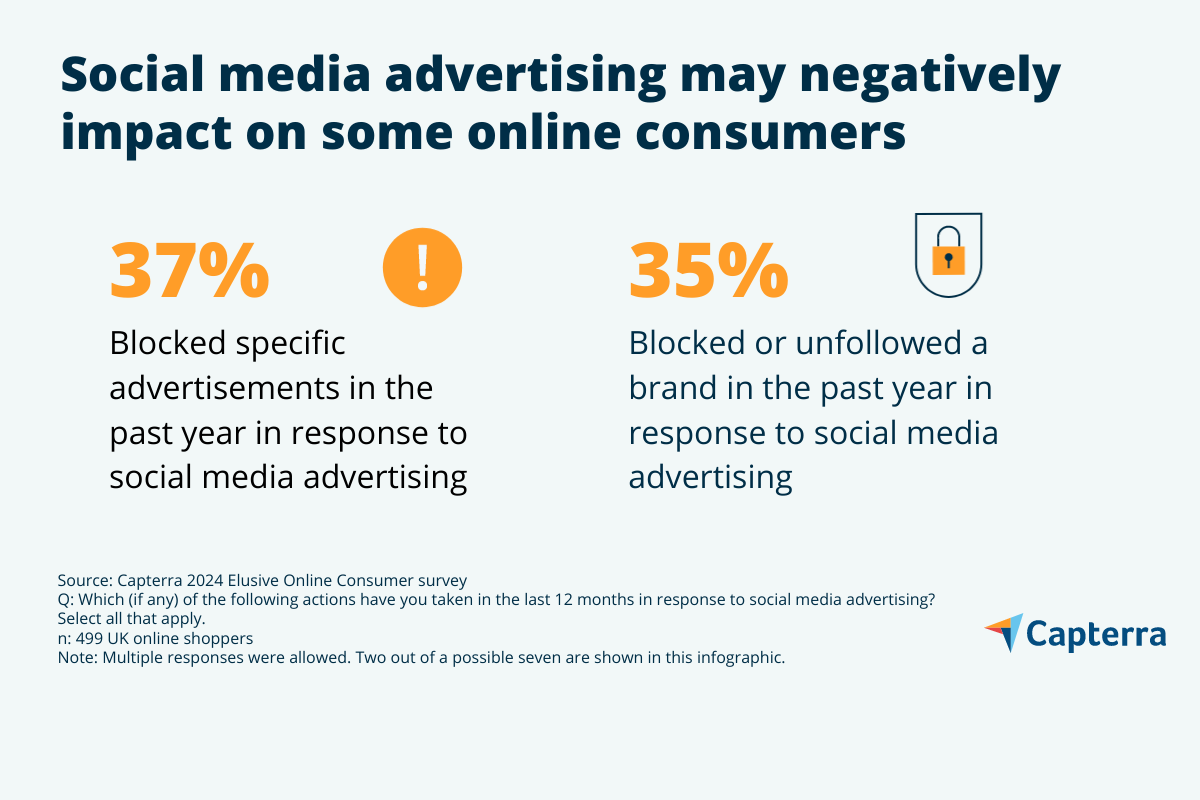

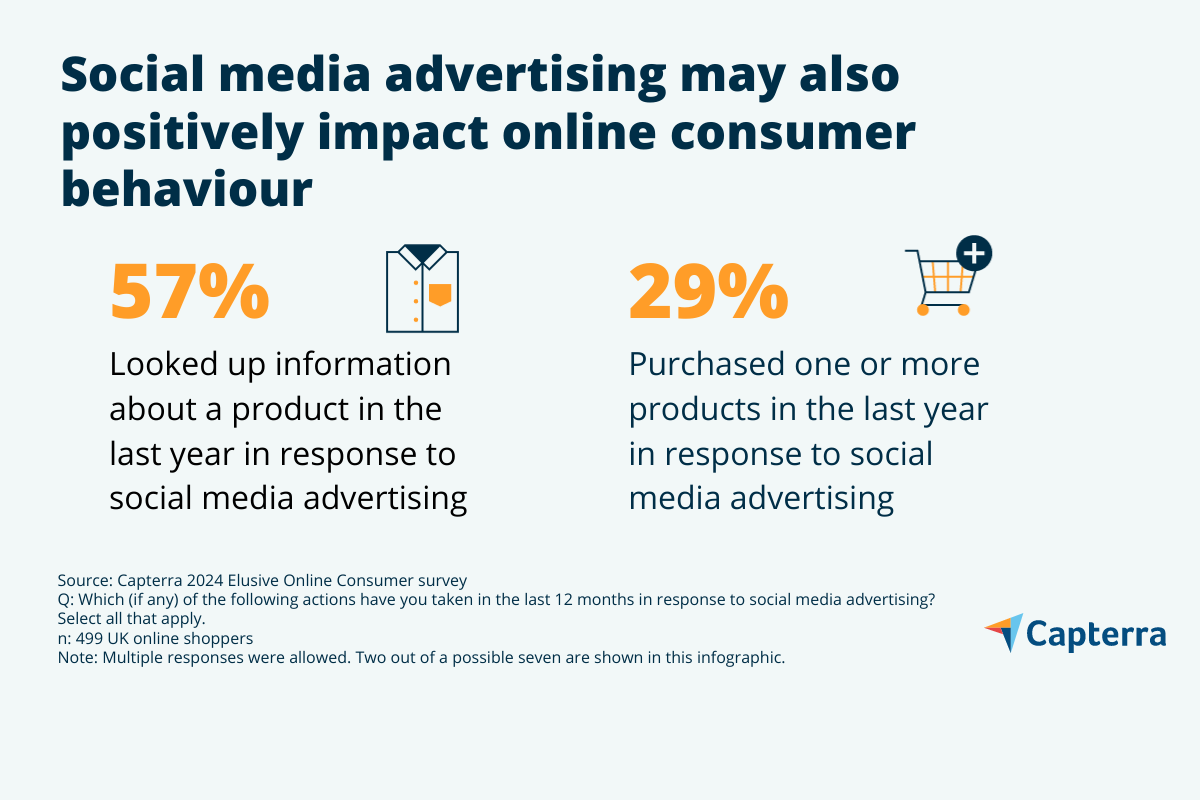

There are risks at stake if brands don’t play their cards right, and this is reflected when we asked online shoppers what actions they had taken in the last year in response to social media advertising.

Even though a portion of consumers may be prompted to block adverts or brands if they are saturated with adverts, one of the virtues of social media advertising is that it allows brands to target desired audiences and maximise brand awareness. If brands can effectively combine social media marketing tools with social media monitoring software to help them identify trends and customer sentiment, they can better understand their audience and experience the benefits.

Businesses should leverage social media to provide the services that consumers want them to provide. While 33% of online consumers do not want to interact or engage with brands on social media, 48% would be open to engaging with brands if they sent offers or discounts. Additionally, 45% of online consumers find it acceptable to receive ads for products relevant to their interests.

How to evaluate the performance of social media campaigns?

Consequently, businesses may need to evaluate the quality of their targeted campaigns over the quantity and manage their social media campaigns to ensure that they are sending the right messages to their targeted audience. There are several ways businesses can evaluate the quality of their campaigns. These include:

- Measuring engagement and conversion rates: Analytics tools can help businesses measure shares, comments, clicks, and conversion rates to gauge how audiences interact with and make online purchases as a result of online ads.

- Tracking reach and impressions: Another feature of analytics and display advertising is that businesses can evaluate how many people were exposed to an ad and how frequently it was seen. This can help businesses refine their ads and better plan who to target. Businesses can refine or test these processes using segmentation or A/B testing to see which adverts or approaches work best.

- Gathering audience insights and feedback: Survey tools and social media messages can be used to gain insights into potential customers' interests, dislikes, or concerns.

Consumers often use dark social media to recommend or explore brands

Although tracking marketing campaign engagement is important to avoid ad fatigue, there are other avenues that are more difficult —or even impossible— to track. Consumers are retreating into what is known as dark social media channels. This refers to social sharing that occurs through private channels, such as direct messaging, email, or secure browsing, making it difficult to track and measure. Seeking respite from overt advertising, online consumers may use untrackable methods to interact or recommend products. As opposed to the 24% of online consumers who recommend products on social media channels, other methods include:

- Conversations either in-person or phone calls: (76%)

- Private messages and/or group chats: (49%)

- Email (12%)

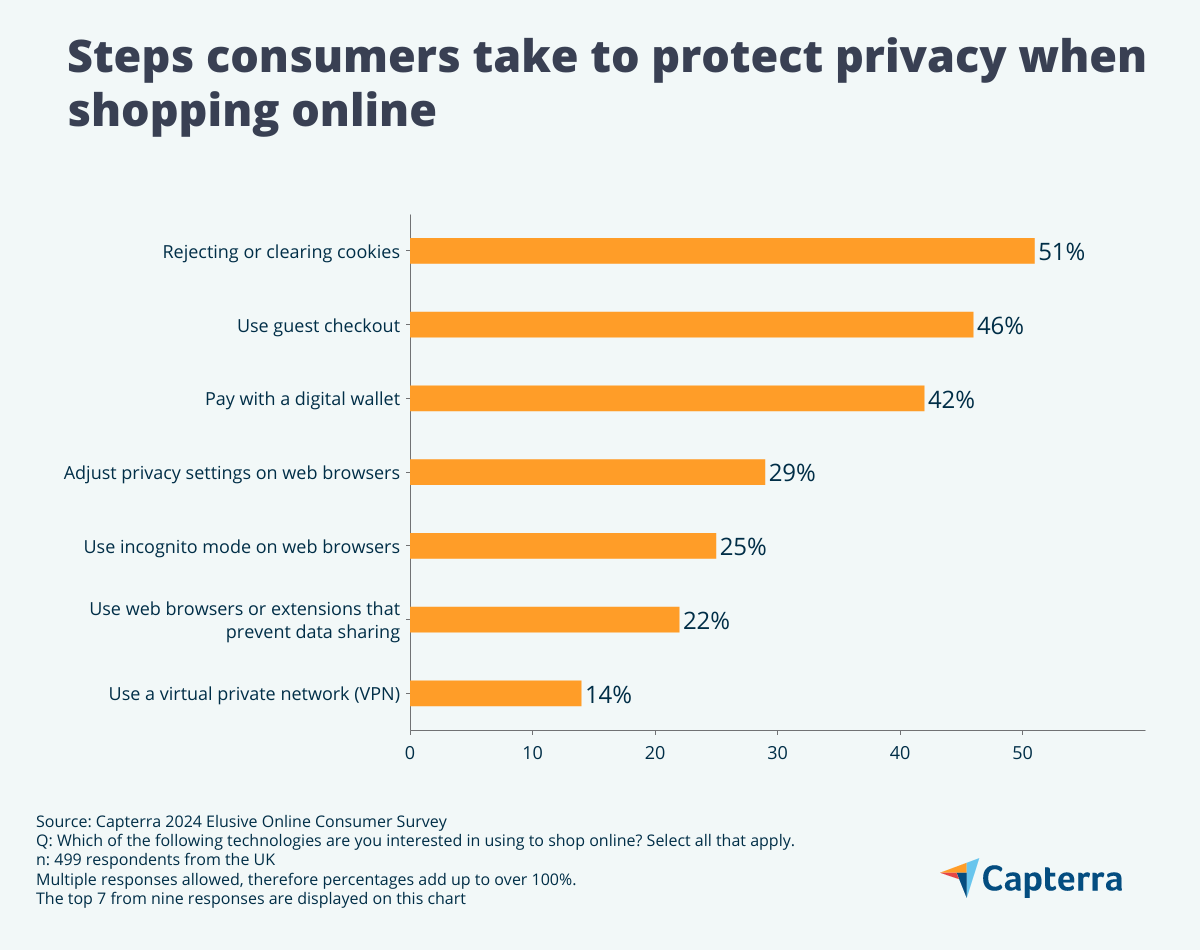

There are also actions consumers can take to safeguard their privacy or prevent being tracked when making purchases online.

Even though services like guest checkouts and digital wallets can make it more difficult for companies to track consumer activity, this should not deter brands from using these features. UK consumers expect businesses to allow them to use guest checkout and feel more in control of their privacy when they use digital wallets. Instead, businesses should focus on what they can do to make their social media marketing more efficient or seek new ways to attract consumer attention.

Tips on how to overcome untraceable sharing on dark social media

Dark social media can be pervasive, stemming from private, untraceable communication channels. It can affect a retailer's analytics by hiding where visits are coming from and making it difficult to define audience characteristics. How can businesses tackle this issue?

- Implement URL shorteners and UTMs: By utilising tools that shorten URLs and condense links, along with UTMs to add tracking parameters, retailers can receive more accurate measurements of dark social traffic and leverage insights into its sources.

- Encourage easy sharing: Make sharing content effortless by incorporating sharing buttons into online assets and content. This includes emails and messaging platforms. Ensure that these buttons are equipped with UTM parameters to help track these shares.

- Be transparent about data usage: If shoppers are wary about their privacy, businesses should build trust with their audience by being transparent about how their data is used. This requires clearly communicating data usage policies and respecting privacy preferences.

Filters and search solutions can enhance onsite discoverability

Even though social media marketing may pose some challenges to businesses that want to increase their customer base, there are other ways to guide online shoppers in their purchase journey. This is where the role of search solutions in guiding online shopping becomes paramount.

Once shoppers arrive on an e-commerce site, they need to easily access products they may be interested in. These consumers are presented with different routes to find a product. Shoppers can browse through specific pages or categories or use search bars or filters.

More than three-quarters (79%) of online shoppers who begin their product searches on retailers’ websites or apps typically browse by category. In addition, 55% browse the sales page or discounts. This asserts the importance of having clearly categorised sections in a sitemap and catering to customer demands for discounts.

However, 65% of online consumers who initiate their shopping on a retailer’s site begin their search using the search bar or filters. Filters can play an important role in allowing these consumers to refine their product searches, with 96% saying they sometimes, often, or always use these filters to narrow their product search when shopping online. With this in mind, the most commonly used filters are those for price (85%), size (73%), and brand (53%).

Still, retailers must address common challenges encountered by online shoppers who use these filters and search tools. Inaccurate filters or searches can lead to frustration, and in the case of search bars, 50% of online shoppers said there were too many sponsored results or ads when they searched for a product.

How can businesses make sure their website filters are optimised?

To ensure accurate and relevant website search filters, there are several steps businesses can take. These include:

- Understand user intent: By using analytics tools to study user behaviour and preferences, retailers can determine what filters are most effective in user searches.

- Create clear taxonomies: Properly tagging filters and creating clear categories can lead to a more accurate representation of products or content.

- Regularly update filters: Keeping product catalogues updated with new products and content can help keep search results relevant.

- Test and refine filters: Continuously testing and refining filters based on user feedback and performance metrics can help retailers decide which filters work best and how to present them effectively.

- Provide multiple filter options: Various filter options, including sorting, price ranges, size, and brand can cater to different user preferences.

- Optimise speed and performance: Retailers should regularly check their filters and search options to make sure they load quickly and work seamlessly across different devices and platforms.

Next-generation search solutions should focus on discounts and personalisation

Along with filters, online consumers want to use search bars to help them find products on retailer websites. However, we have seen that they often encounter obstacles. Retailers may need to address these hurdles by leveraging emerging technology to provide a better search experience. Nonetheless, it is important that businesses do not deploy technology too quickly without evaluating whether this is really what the consumers want.

But how popular are they? Even though 52% of online shoppers say they are not interested in using next-gen technology when they shop online, there are technologies that can still be applied to help bolster product discovery, such as:

- AI-driven recommendations: With 19% of online shoppers willing to use this technology, predictive analytics and machine learning algorithms can help anticipate consumer preferences and behaviour, delivering personalised search results and recommendations in real-time. Incorporating advanced search algorithms and natural language processing (NLP) technologies may help improve search accuracy and relevance.

- Chatbots: Natural language processing and conversation technologies can help enhance product discovery. AI-chatbots can provide personalised assistance and guidance to customers and even recommend relevant products based on preferences and browsing history. With this in mind, 18% of online shoppers are interested in using this technology when shopping online. However, 82% have never actually used an AI chatbot to search for products online.

- QR codes: Online shoppers can scan QR codes with their smartphones to instantly access product details, seamlessly transitioning from offline to online discovery. By integrating QR codes into marketing materials or product packaging, consumers can be encouraged to explore a retailer's website further. 17% of online shoppers are open to using these technologies in the purchase journey.

- Augmented reality (AR) or virtual reality (VR): Integrating visual search capabilities can allow consumers to search for products immersively. With 17% of online shopping interested in using these technologies in their online shopping experience, this enables customers to visualise products in real-world settings, try on their clothing, or see how furniture may fit in their homes.

A common element of next-generation technologies is the importance of delivering personalised product recommendations. For the majority of consumers (71%), this means providing updated offers or deals. However, 42% would also like recommendations based on past purchases; 40% would like to see products that have been bought by customers with a similar profile; and 26% would welcome recommendations based on their search or viewing history. All these are elements that brands can incorporate into their websites using next-generation technologies.

Businesses should leverage technology but focus on what consumers demand

Online shopping offers convenience and discovery opportunities for online retail consumers. To reach their products, these consumers use search engines, retailer websites, and social media to reach their objectives. However, retailers must be cautious when advertising on these channels to avoid ad fatigue. In doing so, they should balance engaging consumers on social media with selective, quality, targeted advertising, while respecting their privacy preferences.

When it comes to retailer websites, advanced filters and next-gen search solutions like AI-driven recommendations and chatbots can enhance product discovery and deliver personalised experiences, while keeping an eye on what consumers seek: discounts and personalisation.

Methodology:

Capterra’s 2024 Elusive Consumer Survey was conducted in April 2024 among 5,585 respondents in the US (500), UK (499), Canada (500), Brazil (497), Mexico (470), France(271), Italy (496), Germany (496), Spain (359), Australia (497), India (500) and Japan (500). The goal of the study was to learn about how today’s online consumers shop. Respondents were screened to have shopped online several times a month or more often.

Capterra interviewed 499 UK citizens. The candidates had to be UK residents over the age of 18.