The COVID-19 crisis has led to a decrease in cash usage, rather than an increase. For the first time, people are looking at ways to use cashless payments in the UK. Cash is seen as a potential transmission of the virus and people are relying on cashless payments options to pay.

The pandemic has had an impact on almost all aspects of our lives, in society and in the business world, pushing SMEs to adopt more point of sale (POS), mobile banking and payment processing software.

We wanted to understand how the pandemic is influencing payment habits in the UK — we asked 1,045 people how they are paying, their preferred methods and if they are planning on changing these since the crisis. (*Full methodology at the bottom of the article).

In this article, we explore the adoption of contactless payments, what is the perception by users in the UK and how has COVID-19 forced this change of payments habits.

Mobile wallets are here to stay

An article from Fintech News states the UK has traditionally been ‘leading the way on mobile wallet adoption’ being the third-highest mobile wallet usage country in the world, with 5% of all point of sale transactions made by mobile.

A mobile wallet is used to define a virtual wallet that has all the information of your debit and credit cards and other methods of payment.

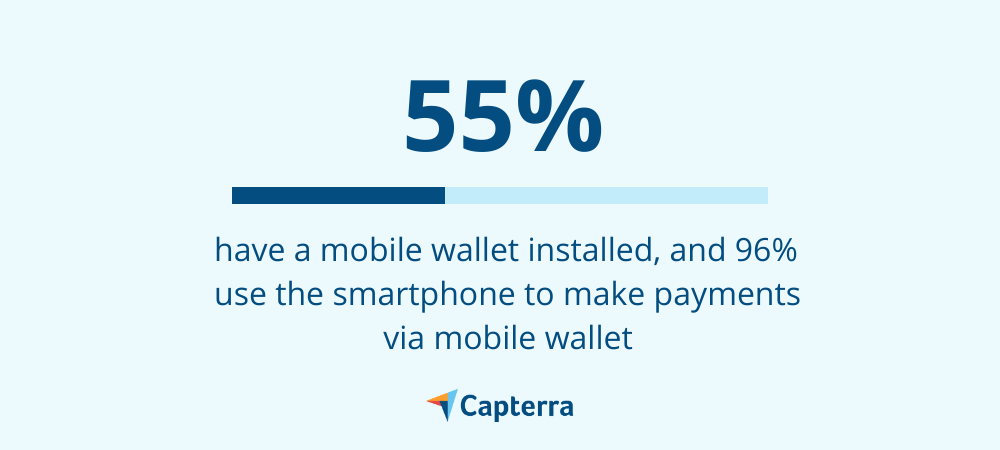

Over half of respond ents have a mobile wallet installed (55%) and the smartphone is the device most used to make mobile payments (96%).

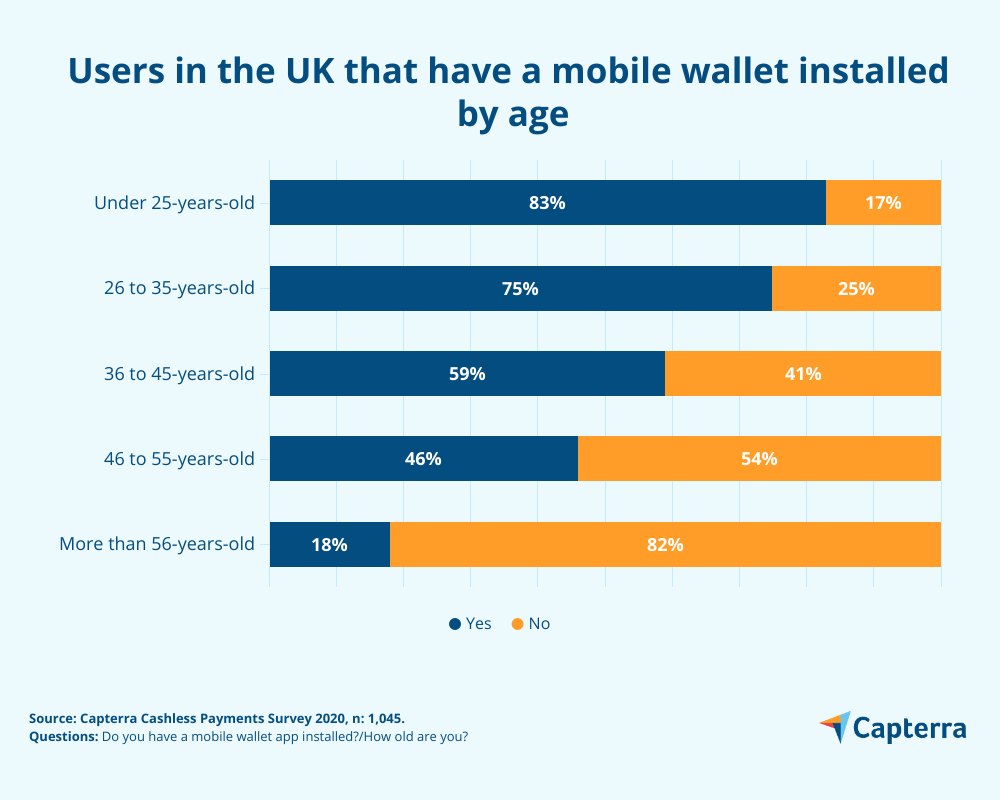

When looking at these figures by age range, respondents aged 18-25 are the highest with a mobile wallet app installed (83%) followed by 26-35 (75%). Looking at the respondents that don’t have a mobile app installed, the age range over 56 has the highest percentage (82%).

Security, still the main concern for users

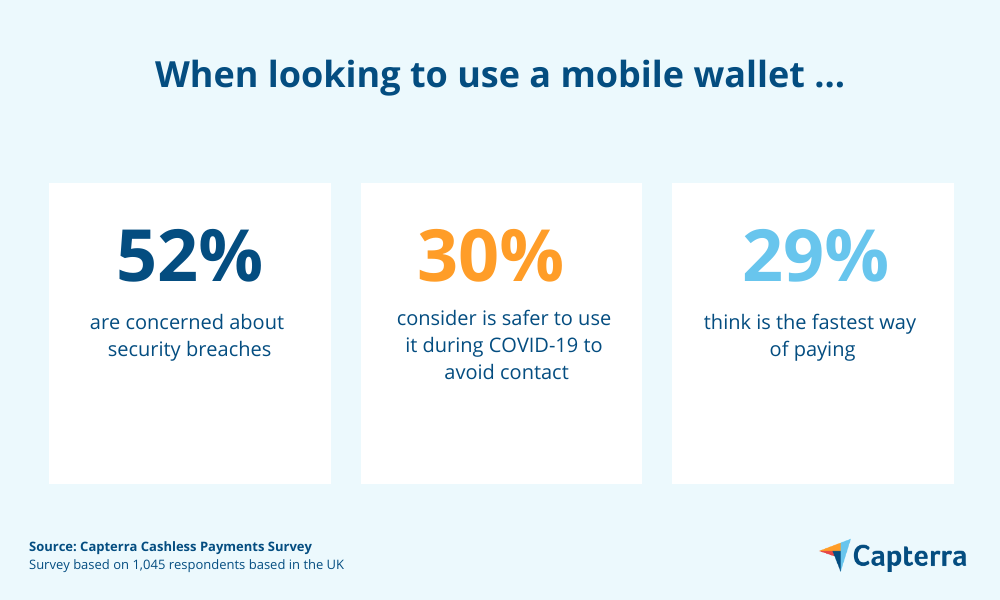

When asked about the advantages of using a mobile wallet app, respondents state health (30%) as the main one. This is not surprising in the current context of COVID-19. With contactless, there is no need to type in the pin and it’s easier to maintain social distancing.

Looking more closely at concerns, half of the respondents state security as the main concern when using contactless payments (52%). For example, not having a pin number or having your card number taken while you are paying by someone standing behind you.

Cashless payments in the UK: A change in the user profile

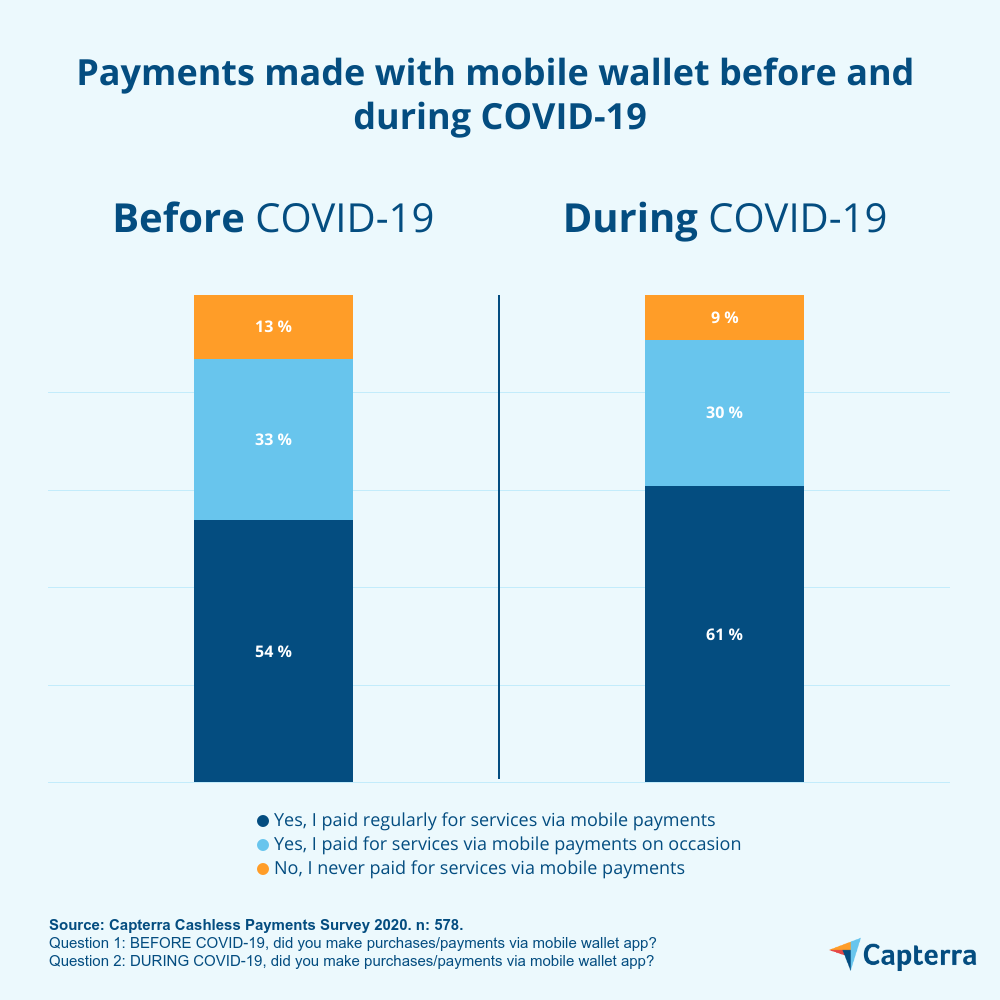

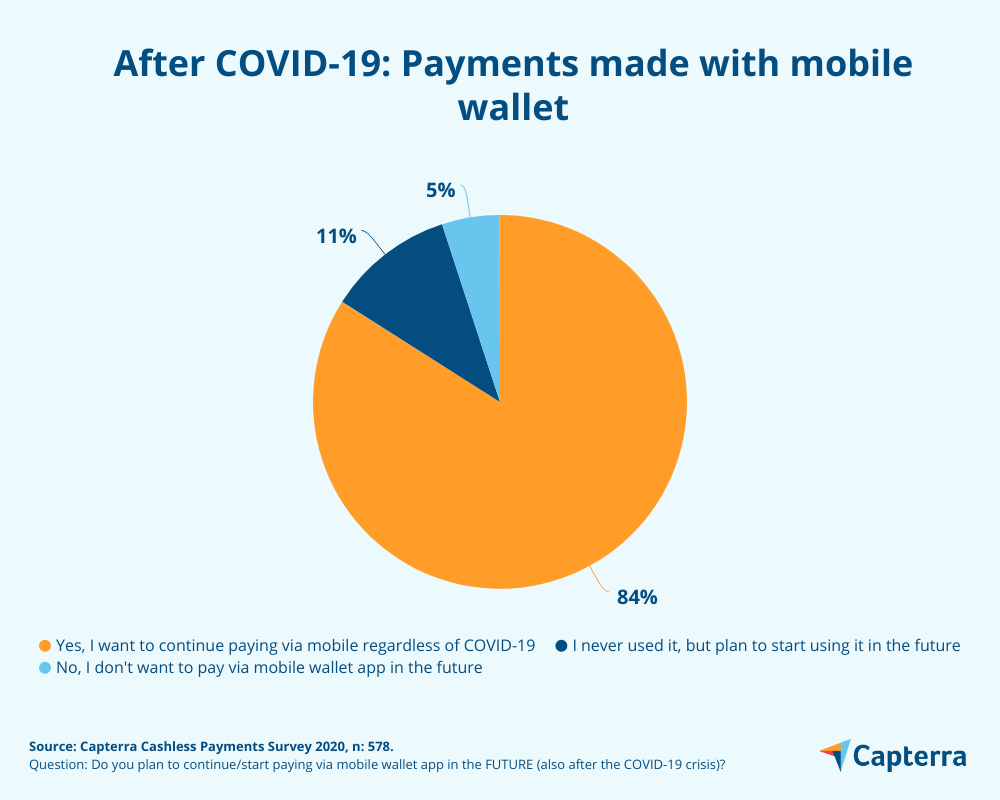

From the respondents that have a mobile wallet installed (578/1045), 87% did pay with a mobile wallet before COVID-19 regularly or on occasion.

Before COVID-19 the age group using a mobile wallet the most is the 16-25 (56%), followed by people aged 26-35 (26%) using it on occasions to pay, but not on a regular basis.

When asked about the plans on continuing to use mobile wallet payments in the future, 84% of respondents state they want to continue paying via mobile and 11% state that they have never used it but plan to start using it in the future.

Respondents over 56 are keen to adopt mobile wallet

When asked about the regularity of usage of mobile wallet app before the pandemic, only 4% of respondents aged 56 and over answered yes and 7% of respondents use it occasionally.

These figures increase slightly when asked about paying habits during the crisis, with 6% stating they pay regularly and 8% pay occasionally.

When asked about how they prefer to pay in the future, respondents in this age range who are keen on paying via mobile wallet app regularly increase to 14%, and 3% occasionally.

The results suggest a positive attitude from these generations to pay via contactless methods.

Furthermore, the results show they have incorporated it during the pandemic, and are keen to continue using it after it. This may suggest a change in payment habits.

Are we ready for a 100% cashless society?

Despite the rise in adoption of mobile wallet apps, cash still has its established place in society.

According to The Guardian, consumers’ atm and cash use “have fallen significantly” since the beginning of the crisis, by around 50%.

Central Banking reports that “Banks in the UK were allowed to ‘increase the limit’on their contactless payments (this is, without having to put in the pin number) since 1st April to help prevent the spread of coronavirus by allowing more people to pay without using cash or handling a card machine.

For example, Barclays introduced a £45 contactless limit in the UK, and the bank reports that it has processed almost 40,700,000 contactless transactions above the previous limit of £30.

54% of respondents stated that they wouldn’t or are not sure if they would feel comfortable in a cashless society (e.g., no cash or coins).

In addition, 43% state that they would only feel comfortable not carrying cash if 100% of the stores would accept a cashless solution.

Out of the 1,045 total respondents, 21% (215) stated they prefer to pay by cash in a shop. The main reasons behind this are that some shops still today don’t offer cashless payments.

* Survey methodology

Data for the “Capterra Cashless Payments Survey” study was collected in July 2020 from an online survey of 1,077 respondents that live in the UK.

The survey data used for this article comes from 1,045 participants who qualified to answer. The information in this article corresponds to the average of all surveyed participants.

Note: There were several answer options available for the graphics so that the total of the percentages exceeds 100%.

The criteria for participants to be selected are:

- Employed full-time

- Employed part-time

- Freelancer

- Full-time student

- Retired

- Participants that lost their job as a result of COVID-19 crisis

All participants come from different industry sectors.